This content has been archived. It may no longer be relevant

Whether you are a just-elected leader or a longtime officer, we’re here to help you with services developed by — and for — PTA volunteers and leaders just like you.

We have tax-filing support to offer assistance, step-by-step filing instructions, tools and forms. When your bylaws need changing, the instructions help keep your PTA up-to-date and on track.

If there is something you need, don’t hesitate to contact us – your council or Florida State PTA. We’re here to help you!

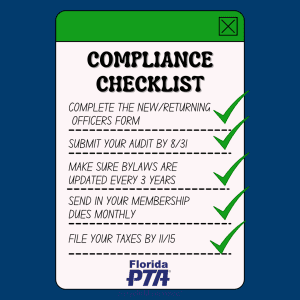

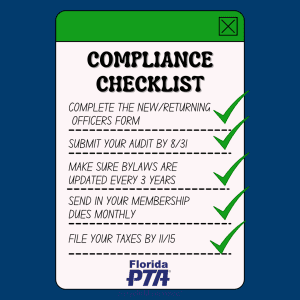

As an organized, chartered local PTA unit in the State of Florida, there are five compliance requirements to continue the affiliation with Florida PTA.

1). Current officers, with a valid email address and home mailing address (the home mailing address is not shared with non-PTA entities)

2). Annual IRS 990 filing

3). Annual Audit (financial review)

4). Membership dues sent monthly as collected, and

5). Bylaws updated within three years.

More information (due dates, etc.) can be found by clicking here.

Please use the New/Returning Officers Registration Form. **If you need to change your officers after initial submission, please email: membership.data@floridapta.org, for specific instructions on how to update officers, or fill out the Change of Officers Form.

PLEASE COMPLETE all required information as soon as officers are elected. You will not receive your login information for MemberHub/Givebacks or the Florida PTA Kit of Materials (which will be emailed after Leadership Convention in July) if this information is not updated each year. Information MUST be completed for President, Treasurer and Secretary, INCLUDING HOME ADDRESSES, a valid and separate email for each, as well as a phone number.

AFTER COMPLETION OF YOUR FORM: Check your email for the email confirmation of the form submission. If you do not receive an email confirmation, the form was not completed properly. The MemberHub/Givebacks login information and Florida PTA Kit of Materials will be sent to each local unit upon receipt of this completed form. (ALL MAILINGS WILL BE SENT TO THE PTA/PTSA PRESIDENT’S EMAIL YOU PROVIDE.)

By providing email addresses, Florida PTA can provide important updates to each member listed. Florida PTA uses this information for its communication purposes only. WE DO NOT PROVIDE OFFICER OR MEMBERSHIP LISTS TO OUTSIDE NON-PTA ENTITIES.

**If you need to change your officers after initial submission, please email: membership.data@floridapta.org for specific instructions on how to update officers, or fill out the Change of Officers Form.

An Audit (Financial Review) must be completed each year, at the end of the fiscal year (July 1 – June 30). Also, if the treasurer changes for your unit, an Audit must be completed. Below is helpful information and forms. If you need additional assistance, please contact your County Council or the State Office at 407-855-7604.

For a helpful Financial Summary Worksheet with formulas, please click here.

Bylaws of the PTA determine its structure and provide specific regulations by which its affairs are governed. The bylaws define or explain the rules under which the PTA functions. They protect the group from error and guide it to efficient service.

The PTA unit should be careful not to include items that should be in the Standing Rules (guidelines for running your Board), as this makes the Bylaws too cumbersome.

A group, upon organization and before becoming a local unit of the Florida PTA, must adopt bylaws to meet its particular needs and submit the original for approval to the State Office. Upon approval the original is kept at the State Office and a copy is emailed to the local unit.

The Florida PTA has compiled a Bylaws Form that includes wording required by both Florida PTA and National PTA. Local PTAs in Florida are required to use the form to be sure that all state/national requirements are included.

Please visit this page for information on requesting and updating bylaws.

Please use the Membership Dues form to submit dues by mail each month as collected. You can also submit dues payment direction via Givebacks/MemberHub. Once a member joins, their membership card will be sent electronically through MemberHub/Givebacks directly.

Click here for important information on filing your 990 with the IRS. Visit this page for more detailed tax-filing information. For additional assistance, please call our State Office at 407-855-7604.

As an organized, chartered local PTA unit in the State of Florida, there are five compliance requirements to continue the affiliation with Florida PTA.

As an organized, chartered local PTA unit in the State of Florida, there are five compliance requirements to continue the affiliation with Florida PTA.